Global Poverty Soars – As Incomes of World’s Billionaires Hit New Highs

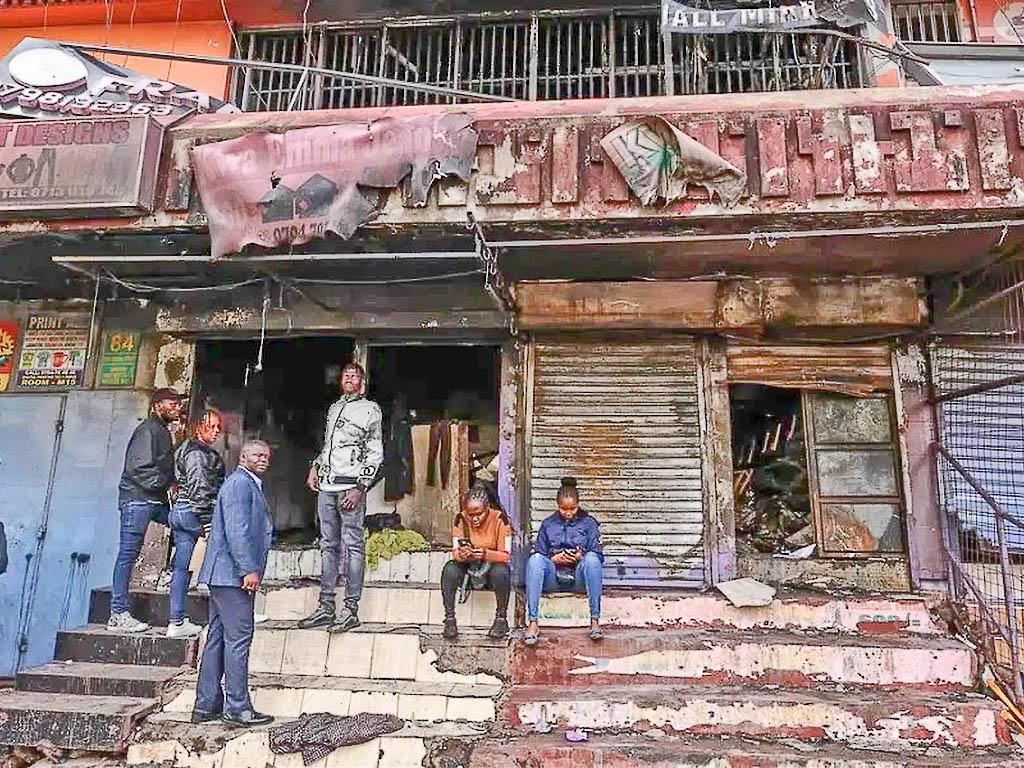

IPS 15.10.2020 Thalif Deen Translated by: Jpic-jp.orgThe phenomenal rise in extreme poverty -– for the first time in 20 years — has been accompanied by an upsurge in the incomes of the world’s billionaires and the super-rich.

The paradox of poverty amidst plenty is being blamed largely on the coronavirus pandemic which has driven millions, mostly in the developing world, into a state of perpetual poverty: the rich are getting richer and the poor poorer– which may also reflect the realities of widespread economic inequalities worldwide.

The world’s total population is around 7.8 billion, and according to the UN, more than 736 million people live below the international poverty line.

A World Bank last report said extreme poverty is set to rise this year, for the first time in more than two decades, the impact of the spreading virus is expected to push up to 115 million more people into poverty, while the pandemic is compounding the forces of conflict and climate change, that has already been slowing poverty reduction. By 2021, as many as 150 million more people could be living in extreme poverty.

At the other end of the scale, the wealth of the world’s billionaires reached a new record high in the middle of the pandemic, primarily as “a rebound in tech stocks boosting the fortunes of the global elite”, according to a report released by UBS Global Wealth Management and PwC Switzerland.

Providing a sheaf of statistics, the report said total wealth held by billionaires climbed 27.5% to $10.2 trillion last July, described as “a new high”, compared with $8.9 trillion in 2017. The number of billionaires worldwide has been estimated at 2,189, up from 2,158 in 2017. The rising earnings were mostly from three sectors, including tech, health care and industry—a trend accelerated by the pandemic. The study also says the rise in billionaires has led to greater philanthropy, with some 209 billionaires pledging $7.2 billion in donations.

However, according to Pooja Rangaprasad, Director, Policy and Advocacy, Financing for Development (FfD) at the Rome-based Society for International Development (SID), “philanthropy or charity is not a substitute for systemic solutions”. Many developing countries are already on the brink of debt crises which is further exacerbated by a broken international tax system that allows wealthy corporations and individuals to pay little to no taxes.

“Unless global economic solutions are prioritized to ensure developing countries have the fiscal space to respond to the crisis, the consequences will be devastating with millions being pushed back into extreme poverty”. She warned that governments need to urgently agree on systemic solutions such as debt cancellations, a binding and multilateral UN framework for debt crisis resolution that addresses unsustainable and illegitimate debt and a UN tax convention to fix loopholes in the international tax system.

Professor Kunal Sen, Director of UN University World Institute for Development Economics Research (UNU-WIDER), told IPS the pandemic is going to push millions of households into poverty, all around the developing world. “The challenge for the international community is to channelize additional resources through Official Development Assistance (ODA) to low income countries, where global poverty is concentrated”.

“The UN can play an important role in mobilizing resources for financing the efforts of the member states to counter the effects of the pandemic on the poor and vulnerable in their own countries”, said Dr Sen.

The projected rise in poverty is also undermining one of the UN’s 17 Sustainable Development Goals (SDGs) which targets the eradication of extreme poverty and hunger by 2030. According to the World Bank, “extreme poverty” is defined as living on less than $1.90 a day. This increase in poverty would be the first since 1998, when the Asian financial crisis shook the global economy.

Before the pandemic struck, the extreme poverty rate was expected to drop to 7.9% in 2020. But now it is likely to affect between 9.1% and 9.4% of the world’s population this year, according to the bank’s biennial ‘Poverty and Shared Prosperity Report’. Its president, David Malpass, said, “The pandemic and global recession may cause over 1.4% of the world’s population to fall into extreme poverty.” To reverse this “serious setback”, countries would need to prepare for a different economy post-Covid, by allowing capital, labor, skills and innovation to move into new businesses and sectors.

Malpass offered World Bank grants and low-interest loans to developing countries, worth $160 billion to help more than 100 poorer countries tackle the crisis.

According to Ben Phillips, author of ‘How to Fight Inequality’, however, the concentration of wealth amongst a handful of oligarchs, and the spread of impoverishment to hundreds of millions more people, are not the disconnected coincidences, but are two sides of the same bad penny.

COVID-19 has not created obscene inequality, it has just supercharged it. In this systemic crisis, the healing impact of philanthropy will be no greater than a novelty sticking plaster on a gaping wound.

As the Pope, the UN Secretary-General, the President of Ireland and the Prime Minister of New Zealand have all pointed out, there is only one non-disastrous way out of this, and that is a rebalancing of economies to serve ordinary people, he noted. “That is absolutely doable – indeed, we’ve done it before – but markets cannot self-correct, and elites never bestow a fair economy from on high. Only pressure from ordinary people can produce an economy that is humane and safe.”

Dereje Alemayehu, Executive Coordinator, Global Alliance for Tax Justice, told IPS inequality is rising in every country; so also, is the income of billionaires. These are causally linked.

“Multinationals and the wealthy do not pay their share of taxes, thus depriving countries the public revenue needed to address inequality.” Furthermore, the prevailing international financial architecture denies developing countries their right to tax their share in global profit of multinationals. To adequately address inequality, national governments should introduce progress and redistributive tax systems. But his would not be enough.

“Developing countries should also reclaim their taxing rights on global profit. For this, a UN led intergovernmental process, in which member states participate on an equal footing, should be established to pave the way for the reform international tax rules and standards,” said Alemayehu, who is also Senior Advisor – Economic Policy at Tax Justice Network Africa.

See the original text Global Poverty Soars – As Incomes of World’s Billionaires Hit New Highs

EDitt | Web Agency

EDitt | Web Agency

Leave a comment